Custodian REIT (LSE: CREI), the UK commercial real estate investment company, today reports its unaudited net asset value (“NAV”) as at 31 December 2019 and highlights for the period from 1 October 2019 to 31 December 2019 (“the Period”).

Financial highlights

- NAV total return per share[1] for the Period of 1.7%

- Dividend per share approved for the Period of 1.6625p

- NAV per share of 104.4p (30 September 2019: 104.3p)

- NAV of £430.2m (30 September 2019: £428.5m)

- Net gearing[2] of 23.2% loan-to-value (30 September 2019: 20.5%)

- £1.6m of new equity raised during the Period at an average premium of 12.1% to dividend adjusted NAV per share

- Market capitalisation of £469.7m (30 September 2019: £483.0m)

Property highlights

- Property value of £571.2m (30 September 2019: £547.2m)

- Acquisition of a portfolio of eight industrial properties for aggregate headline consideration of £24.65m[3]

- £2.4m valuation increase from successful asset management initiatives

- £0.6m aggregate valuation decrease (0.1% of property portfolio)

- EPRA occupancy[4] 95.6% (30 September 2019: 95.5%)

[1] NAV per share movement including dividends approved for the Period.

[2] Gross borrowings less cash (excluding tenant rental deposits and retentions) divided by property valuation.

[3] Before acquisition costs and completion balance sheet adjustments.

[4] Estimated rental value (“ERV”) of let property divided by total property ERV.

Net asset value

The unaudited NAV of the Company at 31 December 2019 was £430.2m, reflecting approximately 104.4p per share, an increase of 0.1p (0.1%) since 30 September 2019:

The NAV attributable to the ordinary shares of the Company is calculated under International Financial Reporting Standards and incorporates the independent property valuation as at 31 December 2019 of £571.2m (30 September 2019: £547.2m) and income for the Period but does not include any provision for the approved dividend of 1.6625p per share for the Period to be paid on 28 February 2020.

Acquisitions and disposals

On 1 October 2019 the Company acquired the share capital of John Menzies Property 4 Limited to facilitate the purchase of a portfolio of industrial/distribution units (“the Menzies Portfolio”) for an agreed headline purchase price of £24.65m via a sale and leaseback transaction with Menzies Distribution Limited (“MDL”). The Menzies Portfolio comprises eight units across the UK with a passing rent of £1.61m, reflecting a net initial yield[6] (“NIY”) of 6.4%. The Menzies Portfolio’s weighted average unexpired lease term to first break or expiry (“WAULT”) was 8.8 years.

[6] Passing rent divided by property valuation plus purchaser’s costs.

No disposals were made during the Period although but we will continue to rebalance the portfolio to focus on strong locations while working on an orderly disposal of those assets we believe are ex-growth.

Property market

Commenting on the regional commercial property market, Richard Shepherd-Cross said:

“The final quarter of 2019 was dominated by concerns of uncertainty surrounding Brexit and the General Election in December, causing market activity to be reduced significantly. By the end of the year investment activity over the whole year was 25-30% down on 2018, with many investors reducing their exposure to real estate, following the theme of uncertainty that had run through a large part of the year. By early December this disinvestment saw most closed-ended property investment trusts trading at a discount to NAV and led the M&G open-ended property fund to suspend redemptions while it rebuilt its cash reserves. Custodian REIT’s share price maintained its premium to NAV during the Period, reflecting its high dividend yield and the robustness of its closed-ended structure. Happily, market confidence has picked up strongly following the General Election result and the political stability that a majority government usually promises. Closed-ended property investment trusts’ share prices have quickly re-rated reflecting increased investor confidence. However, the perennial challenge of open-ended property funds has kept redemptions from the M&G open-ended property fund suspended and, as yet, there is little to demonstrate a turnaround in investor sentiment for the open-ended property fund structure.

“The defensive quality of income has been shown to protect total returns in the face of weak or falling capital values. While the acquisition costs of the Menzies Portfolio have been largely offset by asset management activities, Custodian REIT’s strong income flows have been the principal driver of return, despite continued falls in retail values.

“It is a telling statistic that Custodian REIT’s occupancy level has improved from 95.5% to 95.6% during the Period, demonstrating continued occupier demand for the properties in our portfolio in the face of political uncertainty generally and a difficult landscape for retailers. The market, excluding retail, moves into 2020 with a strong tailwind of growing occupier confidence and a backlog of delayed investment decisions and historical under-investment.

“Diversification across the Custodian REIT property portfolio has protected values in aggregate, with continued growth in the industrial and logistics sector of the property portfolio countering further weakness in retail, fuelled by downward pressure on rents. While we should expect some further decline in retail rents we are not predicting a significant increase in the vacancy rate of our property portfolio. In core locations in regional towns and cities, representative of most of Custodian REIT’s property portfolio, many retailers still want a physical footprint albeit on revised rental terms. Secondary retail locations are likely to experience greater long-term vacancy levels as well as lower rents and capital values.

“In regional markets smaller lot size industrial and logistics and office buildings remain undersupplied and with latent rental growth. Subject to market pricing we still see value in potential acquisitions in these sectors.”

Asset management

A continued focus on active asset management including rent reviews, new lettings, lease extensions and the retention of tenants beyond their contractual break clauses has broadly offset the negative valuation impact of reductions in ERVs in the high street retail and retail warehouse sectors. Initiatives completed during the Period were:

- Completing a new five year lease with Ascott Transport Limited in Burton upon Trent with annual passing rent of £500k following the surrender of the incumbent tenant’s lease due to its administration, which increased valuation by £1.1m;

- Re-gearing a lease with H&M in Winsford by moving the 2020 break option to 2022 and increasing rent from £400k to £625k, which increased valuation by £0.4m;

- Re-gearing a lease with JB Global (t/a Oak Furniture Land) in Plymouth, extending the term by five years and increasing rent from £235k to £250k, increasing valuation by £0.4m;

- Completing a lease renewal with H Samuel in Colchester where the tenant has taken a five year lease, with annual passing rent falling from £77k to £70k, increasing valuation by £0.3m;

- Completing a new lease with Brooks Taverner at Cirencester where the tenant has taken a 10 year lease with an annual passing rent of £37k, increasing valuation by £0.1m; and

- Completing a new lease with Mtor Limited (t/a Trugym) at Gateshead where the tenant has taken a 10 year lease with annual passing rent of £125k, increasing valuation by £0.1m.

Further asset management initiatives currently underway on other properties in the portfolio are expected to complete during the coming months.

The positive asset management outcomes in the Period have been tempered by the recent exercise of two tenant only break options which have together put annual aggregate rent of £170k at risk. These lease events are reflected in the property portfolio valuation and we are working to mitigate this potential loss of income.

Property portfolio analysis

The property portfolio’s WAULT increased to 5.4 years from 5.3 years in September 2019, largely due to the acquisition of the Menzies Portfolio (8.8 years WAULT) and the completion of asset management initiatives more than offsetting the natural decrease in WAULT due to the passage of time.

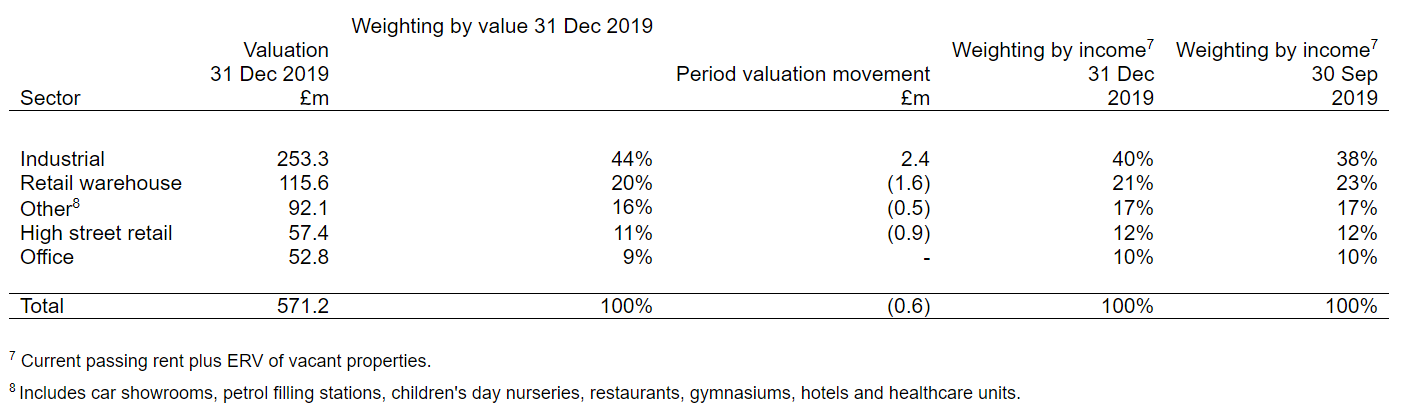

At 31 December 2019 the Company’s property the portfolio comprised 161 assets (30 September 2019: 153 assets) with a NIY of 6.7% (30 September 2019: 6.7%). The property portfolio is split between the main commercial property sectors, in line with the Company’s objective to maintain a suitably balanced property portfolio. Slight swings in sector weightings will reflect market pricing at any given time coupled with the desire to maintain an opportunistic approach to acquisitions. Sector weightings are shown below:

The valuation decrease of £0.6m was primarily driven by high street retail and retail warehouse valuations falling by £0.9m and £1.6m respectively due to a reduction in ERVs. The retail valuation declines were tempered by industrial asset valuations increasing by £2.4m due to active asset management, latent rental growth and continued investor demand.

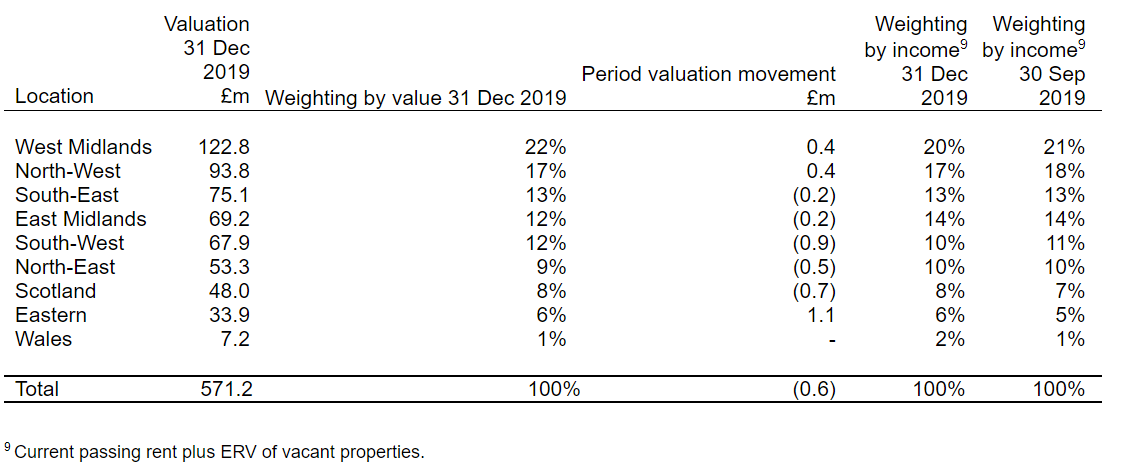

The Company operates a geographically diversified property portfolio across the UK seeking to ensure that no one region represents an overweight position. The geographic analysis of the Company’s property portfolio at 31 December 2019 was as follows:

For details of all properties in the portfolio please see www.custodianreit.com/property-portfolio.

Activity and pipeline

Commenting on pipeline, Richard Shepherd-Cross said:

“We are considering a pipeline of opportunities and have terms agreed to fund the development of a drive-through coffee shop in Nottingham. We believe a selective approach to acquisitions can still yield investment opportunities with latent rental growth and consider the Company well positioned with long-term debt facilities and low net gearing to take advantage of opportunities as they arise.”

Financing

Equity

The Company issued 1.35m new ordinary shares of 1p each (“the New Shares”) during the Period raising proceeds of £1.6m. The New Shares were issued at an average premium of 12.1% to the unaudited NAV per share at 30 September 2019, adjusted to exclude the dividend paid on 29 November 2019.

Debt

At the Period end the Company had:

- A £50m revolving credit facility with Lloyds Bank plc expiring on 17 September 2022 with interest of between 1.5% and 1.8% above three-month LIBOR, determined by reference to the prevailing LTV ratio;

- A £20m term loan with Scottish Widows plc repayable on 13 August 2025 with interest fixed at 3.935%;

- A £45m term loan with Scottish Widows plc repayable on 5 June 2028 with interest fixed at 2.987%; and

- A £50m term loan with Aviva Investors Real Estate Finance comprising:

- A £35m tranche repayable on 6 April 2032 with fixed annual interest of 3.02%; and

- A £15m tranche repayable on 3 November 2032 with fixed annual interest of 3.26%.

Dividends

An interim dividend of 1.6625p per share for the quarter ended 30 September 2019 was paid on 29 November 2019. The Board has approved an interim dividend relating to the Period of 1.6625p per share payable on 28 February 2020 to shareholders on the register on 31 January 2020.

In the absence of unforeseen circumstances, the Board intends to pay quarterly dividends to achieve a target dividend[10] per share for the year ending 31 March 2020 of 6.65p (2019: 6.55p). The Board’s objective is to grow the dividend on a sustainable basis, at a rate which is fully covered by projected net rental income and does not inhibit the flexibility of the Company’s investment strategy.

[10] This is a target only and not a profit forecast. There can be no assurance that the target can or will be met and it should not be taken as an indication of the Company’s expected or actual future results. Accordingly, shareholders or potential investors in the Company should not place any reliance on this target in deciding whether or not to invest in the Company or assume that the Company will make any distributions at all and should decide for themselves whether or not the target dividend yield is reasonable or achievable.