Custodian REIT reports unaudited net asset value as at 30 September 2019

Custodian REIT (LSE: CREI), the UK commercial real estate investment company, today reports its unaudited net asset value (“NAV”) as at 30 September 2019 and highlights for the period from 1 July 2019 to 30 September 2019 (“the Period”).

Financial highlights

- NAV total return per share1 for the Period of -0.04% with a 1.6625p dividend approved for the Period being offset by a 1.7p decrease in NAV, primarily due to property valuation decreases

- NAV per share of 104.3p (30 June 2019: 106.0p)

- NAV of £428.5m (30 June 2019: £432.7m)

- Net gearing2 of 20.5% loan-to-value (30 June 2019: 22.8%)

- Increase in the Company’s revolving credit facility (“RCF”) from £35m to £50m for a three year term plus a two year extension option, with the interest rate margin above three-month LIBOR reduced from 2.45% to between 1.5% and 1.8%

- £2.9m of new equity raised during the Period at an average premium of 11.9% to dividend adjusted NAV per share

- Market capitalisation of £483.0m (30 June 2019: £484.1m)

Portfolio highlights

- Property value of £547.2m (30 June 2019: £568.0m):

- Disposal of two properties at valuation3 for aggregate headline consideration of £15.7m4

- £7.0m valuation decrease (1.2% of property value), primarily due to decreases in the estimated rental value (“ERV”) of high street retail properties and negative market sentiment for retail assets

- EPRA occupancy5 5% (30 June 2019: 95.9%)

- Continued focus on active asset management

- Since the Period end £24.65m6 invested in the acquisition of eight distribution units

1 NAV per share movement including dividends approved for the Period.

2 Gross borrowings less cash (excluding tenant rental deposits and retentions) divided by property valuation.

3 Before disposal costs of £0.1m.

4 Before rental top-ups and cost guarantees of c. £0.3m.

5.ERV of let property divided by total property ERV.

6 Before acquisition costs and completion balance sheet adjustments.

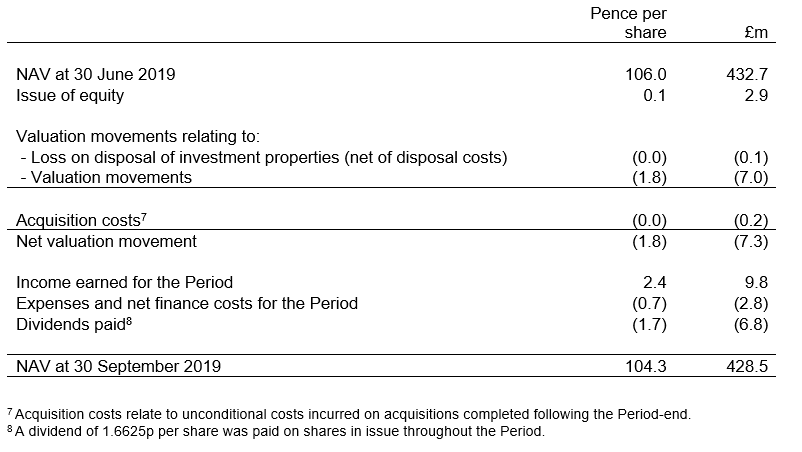

Net asset value

The unaudited NAV of the Company at 30 September 2019 was £428.5m, reflecting approximately 104.3p per share, a decrease of 1.7p (1.6%) since 30 June 2019:

The NAV attributable to the ordinary shares of the Company is calculated under International Financial Reporting Standards and incorporates the independent property valuation as at 30 September 2019 of £547.2m (30 June 2019: £568.0m) and income for the Period but does not include any provision for the approved dividend of 1.6625p per share for the Period to be paid on 29 November 2019.

Acquisitions since the Period end

On 1 October 2019 the Company acquired the share capital of John Menzies Property 4 Limited to facilitate the purchase of a portfolio of distribution units (“the Menzies Portfolio”) for an agreed purchase price of £24.65m via a sale and leaseback transaction with Menzies Distribution Limited (“MDL”). The Menzies Portfolio comprises eight units across the UK with a passing rent of £1.61m, reflecting a net initial yield9 (“NIY”) of 6.4%. The Portfolio’s weighted average unexpired lease term to first break or expiry (“WAULT”) is 8.8 years and the acquisition increased the Company’s net borrowings to 23.2% loan-to-value (“LTV”).

9 Passing rent divided by property valuation plus purchaser’s costs.

Property market

Commenting on the regional commercial property market, Richard Shepherd-Cross said:

“The investment market has been notably quiet this quarter with transaction volumes down 20% from 2018 according to Knight Frank research. While overseas investors still make up a significant proportion of buyers, domestic investors have increased activity to account for 53% of the market. That said, the institutional managers of open-ended funds have recorded low acquisition activity, with most being net sellers of (typically) larger lot-size assets to meet current redemption pressures.

“While reduced transaction volumes tell a story about demand, it is also an issue for supply. Opportunities that meet the investment criteria of Custodian REIT have been in very short supply, resulting in a third quarter where the Company made no property acquisitions.

“Custodian REIT’s investment strategy has always been weighted towards regional industrial and logistics assets, which has stood the Company in good stead again this quarter. Valuation gains of 2.1% in this sector during the Period point to both underlying rental growth and continued investment demand. We expect the addition of the Menzies Portfolio, post Period-end, will prove to be an excellent addition to this sector of the Company’s property portfolio.

“There has been much focus in the press on the woes of retailers and the resulting impact on real estate. There is no doubt that the over-supply of shops on the high street needs to be addressed and, while a number of Company Voluntary Arrangements (“CVAs”) have reduced rents on specific assets, there remains widespread rental value decline as a result of this over-supply. Notwithstanding these falls in rental value, Custodian REIT has continued to focus on maintaining occupancy whilst securing cash flow. We have worked with tenants to retain them in occupation following CVAs and at lease expiry or break, resulting in 96.2% occupancy across our high street retail property portfolio.

“We have previously forecast greater resilience in the out of town retail market, which benefits from a restricted supply, generally free parking and the convenience that is complementary to online sales for both ‘click & collect’ and customer returns. This forecast remains robust, although the read-across from the impact on high street retailers and investors generally turning away from the retail sector as a whole, for the moment is in turn having a negative impact on retail warehouse values.

“Regional offices have provided fairly stable returns over the Period. Sustained demand coupled with low levels of development and restricted supply of Grade A offices in regional markets has led to rental growth, which is most apparent in the six major regional cities where Grade A rents are hitting new headline peaks. Although the costs of office ownership (through landlord’s capital expenditure and tenant lease incentives) remain higher for offices than other sectors, we expect to see a relatively steady market ahead. WeWork is a relatively new entrant into the regional office market but continues to make headlines both corporately and in new office lettings. Time will tell whether it will be complementary or competitive to the Custodian REIT strategy but at present it has minimal impact on the markets in which we operate.

“Custodian REIT benefits from a balanced and diverse property portfolio with 17% of income derived from ‘other’ assets, which are broadly showing resilience from occupiers and continued demand from investors seeking to diversify out of retail.

“This diversification successfully mitigates some of the challenges in retail, whilst the continued asset management of the property portfolio is supporting the Company’s NAV.”

Asset management

Owning the right properties at the right time is one key element of effective property portfolio management, which necessarily involves some selling from time to time to balance the property portfolio. While Custodian REIT is not a trader, it is important to identify opportunities to dispose of assets significantly ahead of valuation or that no longer fit within the Company’s investment strategy.

After focused pre-sale asset management, the following two properties were sold at valuation during the Period for a headline consideration of £15.7m:

- A city centre office unit with retail on the ground floor in Edinburgh for £9.1m, in line with valuation; and

- An industrial unit in Wolverhampton for £6.6m, in line with valuation.

Since the Period-end we have promptly reinvested the proceeds from these disposals into the Menzies Portfolio which is better aligned with the Company’s long-term investment strategy.

A continued focus on active asset management including rent reviews, new lettings, lease extensions and the retention of tenants beyond their contractual break clauses have partially offset the negative valuation impact of reductions in ERVs in the high street retail sector and a reduction in valuation yields due to worsening market sentiment. Initiatives completed during the Period were:

- Completing a lease renewal with Laura Ashley at Colchester where the tenant has taken a five year lease with a third year tenant only break option, with annual passing rent falling from £118k to £106k;

- Completing a lease renewal with Specsavers in Norwich which has taken a 10 year lease with a fifth year tenant only break option, with annual passing rent falling from £200k to £126k;

- Retained Waterstones in Scarborough beyond its contractual lease expiry on a flexible lease arrangement whilst the unit is re-marketed, with annual passing rent falling from £93k to £45k;

- Completed a 10 year lease extension, subject to a fifth year tenant only break option, with Equinox Aromas in Kettering with no change to annual passing rent; and

- Completing six electric vehicle charging point leases to Instavolt across a number of retail warehouse sites within the property portfolio, generating an additional £18k in annual contracted rent on 15 year leases.

Further initiatives on other properties currently under review are expected to complete during the coming months.

These positive asset management outcomes have been tempered by the recent exercise of a tenant only break option effective from August 2020 and two tenants confirming their intention to vacate premises at lease expiry in 2020, which put annual aggregate rent of £650k at risk.

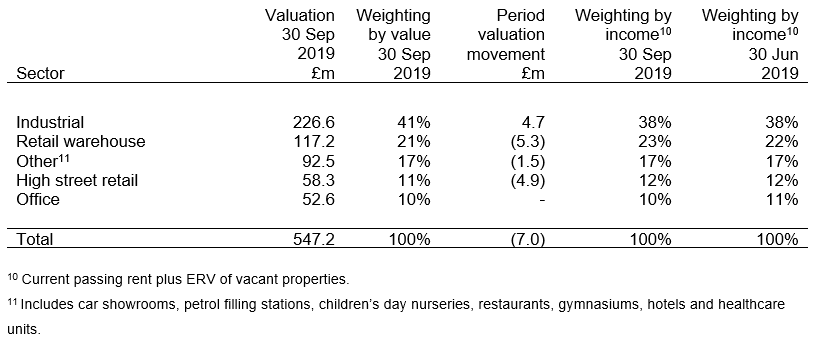

Property portfolio analysis

The property portfolio’s WAULT fell to 5.3 years from 5.6 years in June 2019 reflecting the natural elapse of a quarter of a year due to the passage of time.

At 30 September 2019 the Company’s property portfolio comprised 153 assets (30 June 2019: 155 assets) with a NIY of 6.7% (30 June 2019: 6.7%). The property portfolio is split between the main commercial property sectors, in line with the Company’s objective to maintain a suitably balanced property portfolio. Slight swings in sector weightings reflect market pricing at any given time and the desire to maintain an opportunistic approach to acquisitions. Sector weightings are shown below:

The valuation decrease of £7.0m was primarily driven by high street retail and retail warehouse valuations falling by £4.9m and £5.3m respectively, due to a reduction in high street retail ERVs and a worsening of investment market sentiment towards retail. We believe low rents per sq ft, ‘big box’ formats, free parking and a complementary relationship with online through continued growth in ‘click & collect’ mean retail warehouse valuations and rents are likely to remain more robust than in the High Street during the remainder of the year. The retail valuation declines were tempered by industrial asset valuations increasing by £4.7m due to latent rental growth and continued investor demand.

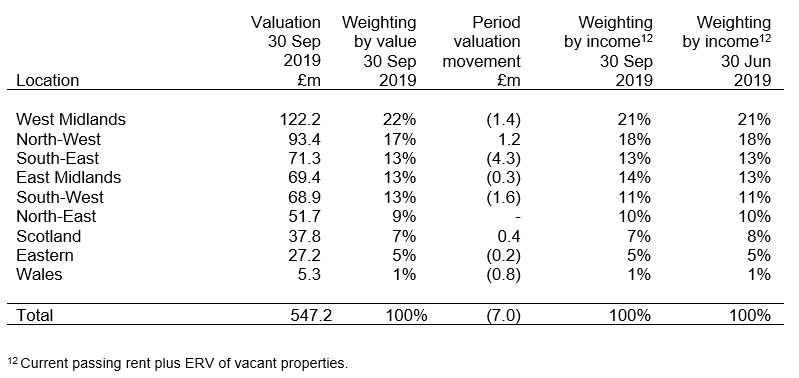

The Company operates a geographically diversified property portfolio across the UK seeking to ensure that no one region represents an overweight position. The geographic analysis of the Company’s property portfolio at 30 September 2019 was as follows:

For details of all properties in the portfolio please see www.custodianreit.com/property-portfolio.

Activity and pipeline

Commenting on pipeline, Richard Shepherd-Cross said:

“We are considering a pipeline of opportunities and have terms agreed to fund the development of a drive-through coffee shop in Nottingham. We believe a selective approach to acquisitions can still yield investment opportunities in the current market and consider the Company well positioned with long-term debt facilities and low net gearing to take advantage of opportunities as they arise.”

Financing

Equity

The Company issued 2.5m new ordinary shares of 1p each (“the New Shares”) during the Period raising proceeds of £2.9m. The New Shares were issued at an average premium of 11.9% to the unaudited NAV per share at 30 June 2019, adjusted to exclude the dividend paid on 30 August 2019.

Debt

On 17 September 2019 the Company and Lloyds Bank plc agreed to increase the total funds available under the Company’s RCF from £35m to £50m for a term of three years, with an option to extend the term by a further two years subject to Lloyds Bank plc’s agreement, and a reduction in the rate of annual interest to between 1.5% and 1.8% above three-month LIBOR, determined by reference to the prevailing LTV ratio. The RCF includes an ‘accordion’ option with the facility limit initially set at £46m, which can be increased to £50m subject to Lloyds Bank plc’s agreement.

At the Period end the Company had:

- A £50m RCF with Lloyds Bank plc with interest of between 1.5% and 1.8% above three-month LIBOR, determined by reference to the prevailing LTV ratio expiring on 17 September 2022;

- A £20m term loan with Scottish Widows plc with interest fixed at 3.935% and is repayable on 13 August 2025;

- A £45m term loan with Scottish Widows plc with interest fixed at 2.987% and is repayable on 5 June 2028; and

- A £50m term loan with Aviva Investors Real Estate Finance comprising:

- A £35m tranche repayable on 6 April 2032 with fixed annual interest of 3.02%; and

- A £15m tranche repayable on 3 November 2032 with fixed annual interest of 3.26%.

Dividends

An interim dividend of 1.6625p per share for the quarter ended 30 June 2019 was paid on 30 August 2019. The Board has approved an interim dividend relating to the Period of 1.6625p per share payable on 29 November 2019 to shareholders on the register on 25 October 2019.

In the absence of unforeseen circumstances, the Board intends to pay quarterly dividends to achieve a target dividend13 per share for the year ending 31 March 2020 of 6.65p (2019: 6.55p). The Board’s objective is to grow the dividend on a sustainable basis, at a rate which is fully covered by projected net rental income and does not inhibit the flexibility of the Company’s investment strategy.

13 This is a target only and not a profit forecast. There can be no assurance that the target can or will be met and it should not be taken as an indication of the Company’s expected or actual future results. Accordingly, shareholders or potential investors in the Company should not place any reliance on this target in deciding whether or not to invest in the Company or assume that the Company will make any distributions at all and should decide for themselves whether or not the target dividend yield is reasonable or achievable.

Inside information

The Board is satisfied that any inside information which the Directors and the Investment Manager may have has been notified to a regulatory information service. The Company is therefore not prohibited from issuing new securities during the closed period which ends on the date of the announcement of the Interim Report for the period ended 30 September 2019.